There is widespread disagreement over the usefulness of so-called stimulus policies. Demand side economists assert that fiscal stimulus (Federal spending increases and tax cuts) can stimulate employment and improve economic growth. Demand Side economists also think that countercyclical monetary policy can stabilize the economy. That is, Federal Reserve officials may stimulate employment, counteract recessions, with inflation- by cutting interest rates and expanding the money supply rapidly.

Milton Friedman asserted that monetary policy is too effective; it overstimulates the economy and causes inflation. Friedman also asserted that fiscal policy has little effect on economic conditions, and is usually poorly timed because Congress acts too slowly. Hence Friedman favors balanced fiscal budgets and slow steady money supply growth, to target zero expected price inflation.

Some economists favor balanced fiscal budgets and a return to the gold standard1.

Most economists want to use fiscal and monetary stimulus to lessen unemployment. However, most economists are not experts on monetary or fiscal economic policies. Most economists specialize in fields of microeconomics (e.g. Industrial Organization, Law & Economics, Environmental Economics...). It should also be understood that economists have given up on the notion of using policy to fine tune the economy. Economists nowadays aim at the vague goal of “coarse tuning” the economy.

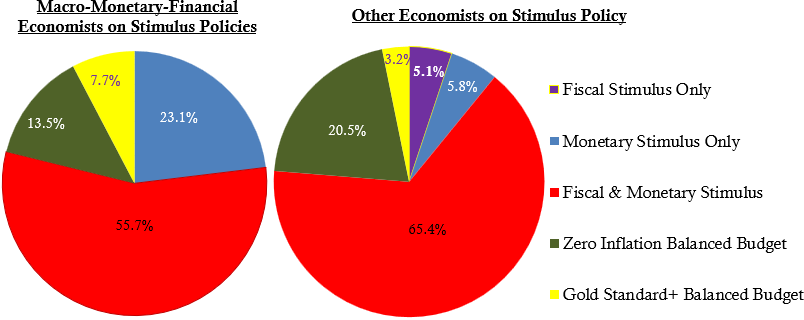

56% of economists with expertise in macro-financial economics recommend both monetary and fiscal stimulus policies. Two thirds of non-experts favor both monetary and fiscal stimulus policies. Only 5.1% of non-experts advise fiscal policy as the sole source of stimulus. Literally none of the macro policy experts surveyed recommended fiscal policy alone. Nearly one quarter of macro experts favor monetary policy alone.

The trouble with fiscal stimulus as a standalone policy is that increases in Federal budget deficits tend to strengthen the dollar. A strong dollar discourages foreigners from buying US exports. A strong dollar also encourages Americans to buy imports2. That is, economists know that fiscal stimulus tends to kill jobs in our export and import competing industries. Monetary stimulus tends to weaken the dollar. What this means is that monetary stimulus encourages US exports and discourages US imports. Hence, monetary policy stimulus can help fiscal stimulus, and it can work on its own.

The handful of economists who support fiscal stimulus as a standalone policy should not be taken seriously3. This begs the question as to why so many politicians support fiscal stimulus policies that economists know to be unecessary, at best. Politicians use Federal spending increases to garner political support, not to “stimulate the economy”.

Close to one quarter of nonexperts favor Milton Friedman's anti-stimulus policies. Curiously, fewer expert macroeconomists side with Friedman, but more than double the percent of these experts favor the gold standard. Friedman was more successful than any modern proponent of the gold standard- but his influence seems mostly to have been to moderate the views of his Demand Sider opponents.

There is a theoretical case for monetary stimulus, but the tendency of economists to support this policy is still hard to fathom. Economists rely on the “Phillips Curve” inflation-unemployment relation as a guide to monetary stimulus. The Phillips Curve, and other such models, have serious deficiencies. The Phillips Curve is unstable to the point of being meaningless (I posted on this here and here recently). Larry Summers (a leading proponent of stimulus policies) admits that Demand Side theorectical models are unconvincing; he supports stimulus policies due to “instinct”. What this all means is that Trump’s fiscal response to the COVID crisis (the CARES Act) was unecessary, and President Biden’s American Rescue Plan of 2021 was positively reckless.

We should not trust what politicians say about the need for stimulus policies because they are concerned with gaining political power, not with doing sound economic policy. We shouldn't automatically embrace the policy advice of most economists either. There is evidence that about 80% of economists donate to left-Democratic political campaigns- this is nearly the same as the percentage of economists who favor stimulus policies4.

Why is this important? The national debt is over $34 trillion and rising as a percent of GDP. The US is not in immediate danger of national bankruptcy. Yet, if we continue to borrow faster than the economy itself grows the United States will go bankrupt.

Lawrence White and George Selgin have argued forcefully in favor of a return to the gold standard and free banking.

It has also been suggested that the effect of fiscal stimulus on interest rates might increase domestic saving and decrease domestic consumption. However, Demand Side Economists tend to assume that private saving is more dependent upon current income than on changes in interest rates.

John Maynard Keynes argued that interest rates can fall to near zero levels during severe recessions, due to a general collapse of private capital investment. With zero interest rates more increases in the money supply would be met by increases in money demand- due to speculation in bond markets. If this were to happen, fiscal stimulus policies would have no impact on imports or exports, or saving. It is not clear that this theory applies to the real world. The Federal Reserve pushed the Federal Funds rate and Treasury bill rates down to zero during the Subprime Crisis and recovery. However, other rates- particularly private bond rates- didn’t fall to zero at that time, or since then. Hence, there was no general “Keynesian collapse of the marginal efficiency of capital”.

Of course, Republican Presidents and Congresses do not have particularly good records of balancing budgets or preventing inflation. However, calls for a Constitutional balanced budget amendment and real reform of the Federal Reserve come exclusively from the Republican Party.