Is the 2022 Recession Real?

The US economy shrank 1.6% in the first quarter of 2022. The Federal Reserve Bank of Atlanta forecasts contraction in the second quarter. If the Atlanta Fed is right, we've already been in a recession for six months. Some economists attribute this unexpected contraction to shifts in inventories and imports. The idea that changes in inventories and in imports slowed the economy is superficial and quantitative. What is the real underlying reason for the recent slowdown in the economy?

Some economists, like Milton Friedman, assert that central banks cause recessions by tightening the money supply. There is considerable evidence behind this proposition. Most recessions begin after the Federal Reserve raises the federal funds rate. However, the Fed raised the federal funds rate slightly on March 17th and more significantly on June 17th of this year. Tight monetary policy will slow commerce in the coming year, but this is not the cause of the slowdown over the past six months.

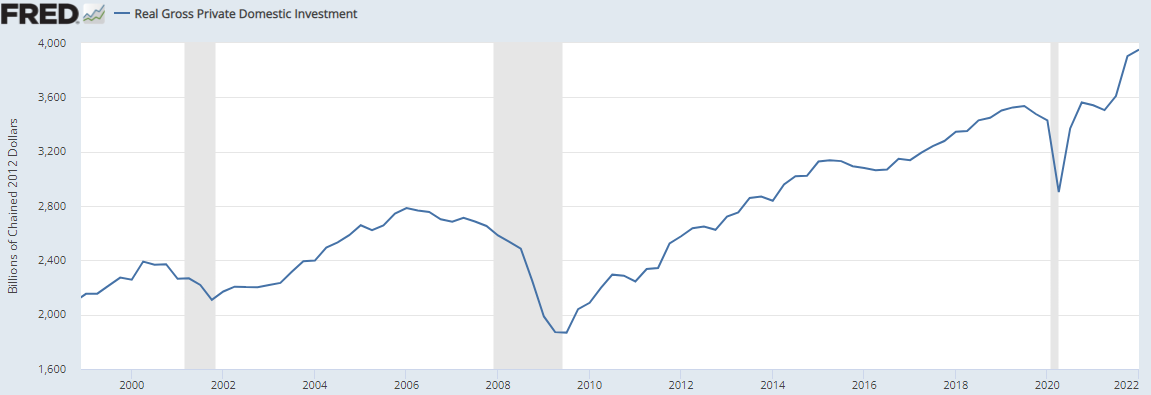

Other economists, like J.M. Keynes, assert that contractions of private investment cause recessions. Real gross private domestic investment rose sharply over the past year, including the first quarter of 2022. Private consumer spending also remained strong during the first six months of this year, even for consumer durables.

Furthermore, employment grew, up to April, and the unemployment rate remains low. There is also some room for further economic growth. Employment levels and labor participation rates are still out of line with pre pandemic trends. To put it differently, actual GDP did not reach full potential in 2021. Actual GDP can exceed potential GDP for two or three years before a recession begins. How can we reconcile data which show employment below potential and growing and the economy contracting?

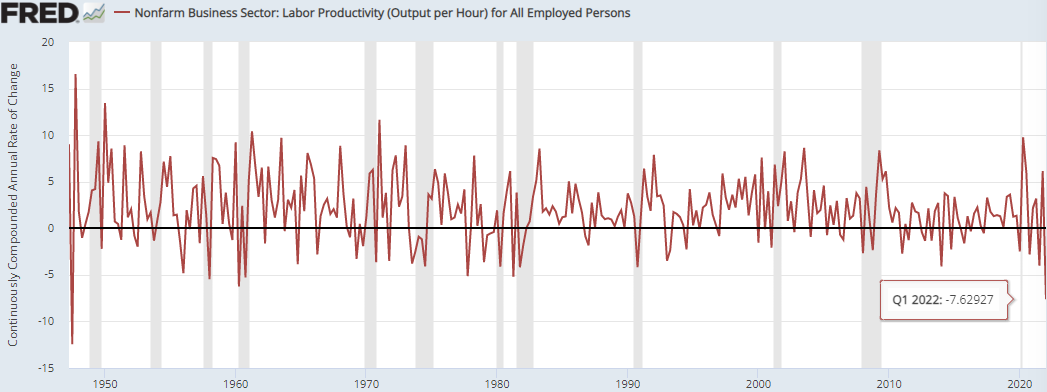

A few economists contend that problems with real productivity (e.g. problems with labor productivity, natural resource supplies, or technology) may trigger recessions. Real GDP (the blue line below) and labor productivity (the red line below) have in fact moved up and down together for decades, except during the COVID crisis.

Hourly productivity shrank at an annual rate of 7.62% during the first quarter of 2022. This is the largest quarterly loss of labor productivity since 1947. Productivity fell modestly in Q4 of 2020 and Q3 of 2021: GDP growth slowed in each of these quarters. Productivity is limiting GDP growth, but why has productivity fallen recently?

Perhaps the COVID pandemic reduced labor productivity. This is certainly possible, but why should the effects of COVID-19 have come on so strongly in Q1 of this year? Regulatory policies affect productivity. Slow recovery from the 2008 crisis coincided with imposition of costly restrictive regulations by President Obama. Gary Cohn implemented deregulation starting in 2017, and the pace of GDP growth quickened. Biden inherited a rapidly recovering economy, with a streamlined regulatory regime and a vibrant domestic energy industry. Biden’s people imposed a heavy-handed costly regulatory environment, and the economy has slowed. Regulatory restrictions have particularly strong in the energy industry. Domestic oil and gas extraction are below pre covid crisis levels; this raises energy costs. Also, the average workweek fell by 24 minutes since April 2021. A large productivity loss and a slight reduction in average working hours seem to have slowed the economy.

Regulation appears to affect labor productivity and GDP significantly and adversely. Data on productivity in specific industries and regulatory changes in those industries could confirm the effects of regulation on productivity and growth.

The economic slowdown likely is a real recession, and it is began with real labor and energy productivity shocks. Are productivity shocks a persistent economic problem? The next reports on labor productivity and on GDP will help us answer this question. In the meantime, President Biden and his advisors should at least try to rethink their heavy-handed regulatory policies.